SCHEDULE 14A INFORMATION

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

¨

¨

x

¨

¨

x

¨

Birmingham, Alabama 35209

22, 2024

12, 2024

Birmingham, Alabama 35209 to be held May 22, 2024 statement and on the frequency that we will hold advisory votes on executive compensation. •by signing and returning the enclosed proxy card in the enclosed envelope; or •by using the internet in accordance with instructions on the enclosed proxy card; or •by using a touchtone telephone and following the instructions on the enclosed proxy card. name”? name”? telephone. respectively. ratification of the appointment of the Corporation’s independent registered public accounting firm. 2025 2026 Rules and Governance Guidelines. Committee Members. rules, as well as under the Governance Guidelines. •Our primary product has historically been professional liability insurance for healthcare providers. We believe that it is important to have on our Board healthcare professionals who are, or have been, consumers of our insurance products and who understand the business and professional needs of our customers. •We believe that it is important to have on our Board persons with business experience, •We believe that it is important that our Board reflect the core values that guide us in fulfilling our mission, supply distributor. director nominees. The composition of our Board demonstrates our commitment to diversity, as three of our eleven independent directors are women, three are African-American, one is Latina, and one is Lebanese born. Further, we are mindful of the need for periodic refreshment of the Board to assure the proper balance between the beneficial knowledge and specific business insights of tenured directors and the new ideas and fresh skills of new nominees. Following the 2024 annual meeting, none of our independent directors will have served on our Board more than eleven years. Board. Our Corporate Governance Principles require our non-management directors to hold executive sessions at which neither management nor the Chief Executive Officer is present. The Corporate Governance Principles further provide that the executive sessions of non-management directors are to be held on a regularly scheduled basis, not less frequently than two times each year, and that at least one of the executive sessions will be attended by independent directors only. Board no less often than annually. Our internal audit department is responsible for reviewing and testing these risk management solutions. All employees are required to undergo training on data security, cyber risk, fraud prevention, and/or privacy-related risks and procedures at least yearly. 24, 2023. •identify individuals qualified to become directors and recommend to the Board of Directors for its consideration the candidates for all directorships to be filled by the Board of Directors or to be elected by the stockholders; •advise the Board of Directors with respect to the board composition, procedures and committees; •develop and recommend to the Board of Directors a set of corporate governance principles applicable to ProAssurance; •oversee the evaluation of the Board of Directors and the evaluation of ProAssurance’s management; •oversee ProAssurance’s efforts to address environmental, social, and governance issues of importance to stakeholders and the •otherwise take a leadership role in shaping the corporate governance of ProAssurance. •the Board of Directors desires to re-nominate an incumbent director for an additional term and the director consents to stand for re-election and to serve on our Board of Directors if elected; or •the Nominating/Corporate Governance Committee has recommended to our Board of Directors a candidate to fill a vacancy and, prior to the receipt of a properly submitted stockholder nomination, such nominee has agreed to stand for election and serve on our Board if elected. •represent and assist the Board of Directors in discharging its oversight responsibility relating to human capital management, with particular emphasis on efforts related to diversity, equity, and inclusion as well as compensation matters, including determining the compensation arrangements for the Chief Executive Officer and reporting its determination to the Board of Directors for ratification by a majority of independent directors; and •review and discuss with management the disclosure under the caption “Compensation Discussion and Analysis” and prepare the report of the Compensation Committee with respect to such disclosure, each of which is to be included in our annual proxy statement. •the accounting, reporting and financial practices of ProAssurance and its subsidiaries, including the integrity of our financial statements; •the surveillance of our administration and financial controls and compliance with legal and regulatory requirements; •the outside auditor’s qualifications and independence; •ProAssurance’s policies on risk assessment and risk management with respect to financial reporting issues; •the performance of our internal auditors. SEC. Warner Bros. Discovery. •alter or repeal any resolution adopted by the Board of Directors that by its terms is not subject to amendment or repeal by the Executive Committee or any resolution relating to the establishment or membership of the Executive Committee; •act with respect to matters required to be passed upon by the full Board of Directors, the independent directors, or by a committee comprised of independent directors; or •act on any matter that has been delegated to the Audit Committee, the Nominating/Corporate Governance Committee or the Compensation Committee in their respective charters. 2023. 2022 Audit fees Audit-related fees Tax fees All other fees Total •the Audit Committee believes would not impair the independence of the auditor; and •are consistent with SEC rules on auditor independence. 2024. 2024. Officer. and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The independent auditor is responsible for performing an independent audit of ProAssurance’s financial statements in accordance with generally accepted auditing standards and expressing an opinion as to their conformity with generally accepted accounting principles. The independent auditor is also required to review the adequacy and effectiveness of ProAssurance’s internal controls on financial reporting. The Audit Committee is directly responsible in its capacity as a committee of the 2023 related to federal and state tax compliance and premium tax filings. , C.P.A. At the 2023 annual meeting our stockholders voted for ProAssurance to continue providing the stockholders this opportunity to vote on executive compensation on an annual basis and we will do so until the advisory vote frequency is required to be reauthorized in 2029. annual meeting: Our Named Executive Officers (“NEOs”) for 2023 were: the executive compensation program. Committee. CEO’s recommendations. The CEO Other Executives profitability. The Consolidated Combined Ratio HCPL New Business (8% weight). CEO Executive Vice President Presidents of Operating Divisions* CEO ProAssurance Executive Vice Presidents President PICA Group President Eastern Group President Medmarc Group stock price performance. Performance shares are based on pre-established performance criteria that must be achieved over a period of three years. Each •Relative Stock Performance (Total Return) — to the CEO and an amount ranging from $175,000 to $200,000 for each other Named Executive Officer. Guidelines employee or member of the Board of Directors.” such plan. Company. gross-up. 31, 2024 W. Stancil Starnes Edward L. Rand, Jr. Howard H. Friedman Jeffrey P. Lisenby Michael L. Boguski 2023. Performance Criteria Return on Equity Gross Written Premium CEO and Executive Vice Presidents Book Value Growth CEO and Executive Vice Presidents Combined Ratio CEO and Executive Vice Presidents President of Eastern The Annual Incentives Awards were paid in cash. Compensation Committee, granted performance shares to the Named Executive Officers. The performance criteria are described in the discussion under “Executive Compensation — Long-term Incentive Compensation” on page cash required for withholding. Name W. Stancil Starnes Edward L. Rand, Jr. Howard H. Friedman Jeffrey P. Lisenby Michael L. Boguski Deferred amounts are contributed to the Deferred Compensation Plan and contributions are credited with deemed investment earnings as if they were invested in one or more designated mutual funds pursuant to an investment election made by the participants as of the date of deferral. Distributions under the plan are made upon termination of employment or service, death, disability, or upon a change of control. Distributions are made in a lump sum or annual installments over a period not exceeding 10 years as elected by the participant. A separate distribution election can be made with respect to each year’s deferrals and matching contributions. •a term •a minimum base salary of •annual incentive compensation •one-time award of restricted stock units with a grant •perquisites consistent with those provided to the prior Chief Executive Officer, including without limitation, up to 50 hours of personal use on the corporate airplane; and •severance payments upon a termination of employment and payments upon a change of control as discussed in more detail under the caption “Payments on Termination and Change of Control.” following change in control. W. Stancil Starnes Cash Severance-Annual Salary Cash Severance-Average Annual Incentive Equity Compensation Vesting(2) Deferred Compensation(3) Medical Benefits Outplacement Services 280G Gross Up TOTAL Edward L. Rand, Jr. Cash Severance-Annual Salary Cash Severance-Average Annual Incentive Equity Compensation Vesting(2) Deferred Compensation(3) Medical Benefits Outplacement Services 280G Gross Up TOTAL Howard H. Friedman Cash Severance-Annual Salary Cash Severance-Average Annual Incentive Equity Compensation Vesting(2) Deferred Compensation(3) Medical Benefits Outplacement Services 280G Gross Up TOTAL Jeffrey P. Lisenby Cash Severance-Annual Salary Cash Severance-Average Annual Incentive Equity Compensation Vesting Deferred Compensation(3) Medical Benefits Outplacement Services 280G Gross Up TOTAL Michael L. Boguski Cash Severance-Annual Salary Cash Severance Noncompete(4) Equity Compensation Vesting(2) Deferred Compensation(3) Medical Benefits Outplacement Services 280G Gross Up TOTAL 2023: Name Samuel A. Di Piazza Robert E. Flowers M. James Gorrie Ziad R. Hydar William J. Listwan(3) John J. McMahon, Jr. Ann F. Putallaz Frank A. Spinosa Anthony R. Tersigni* Thomas A. S. Wilson, Jr. 2023. Subject to approval by the Board of Directors, a director may request that the Company purchase the shares granted and accumulated under the plan at the time the director terminates service on the Board. 31. commissions based solely on the production of business presents a risk of writing unprofitable business in order to obtain a commission. This risk is mitigated by the fact that the decision as to whether business will be written is made by our underwriting staff whose compensation is not commission based and whose incentive compensation, if any, is based on multiple performance measures under one or more of our previously described incentive plans. Stockholders BlackRock, Inc.(2) 40 East 52nd Street New York, New York 10022 The Vanguard Group, Inc.(3) 100 Vanguard Blvd. Malvern, Pennsylvania 19355 T. Rowe Price Associates Inc.(4) 100 East Pratt Street Baltimore, Maryland 21202 •our executive officers named in the Summary Compensation Table under “Executive Compensation,” which we refer to as the “Named Executive Officers;” •our directors and director nominees; and •all of our directors and executive officers as a group. Stockholders Directors Bruce D. Angilillo.† Samuel A. Di Piazza, Jr. Robert E. Flowers M. James Gorrie Ziad R. Haydar William J. Listwan John J. McMahon, Jr. Ann F. Putallaz Frank A. Spinosa W. Stancil Starnes Thomas A. S. Wilson, Jr. Other Named Executive Officers Howard H. Friedman(2) Edward L. Rand, Jr. Jeffrey P. Lisenby Michael L. Boguski his spouse. •Employees are prohibited from (i) taking for themselves personally opportunities that are discovered through the use of ProAssurance’s information or position, (ii) using ProAssurance’s property, information or position for personal gain and (iii) competing with ProAssurance. •If ProAssurance or a subsidiary does business or considers doing business with a company in which an employee or member of his or her family is employed or has a material financial or other interest, the employee must disclose the interest to his or her supervisor if he or she is aware of the proposed business relationship and refrain from participating in the approval process. •If an employee participates in religious, charitable, educational or civic activities, good judgment must be exercised to abstain from involvement in activities which would present a conflict of interest or interfere with responsibilities to or the reputation of ProAssurance. flight hours for personal travel by other authorized users in the aggregate. The Chief Executive Officer must get the prior approval of the Compensation Committee before approving any personal travel which exceeds the aggregate limit. The Compensation Committee may delegate to any of its members the authority to approve requests for personal travel in excess of established limits. Both the Compensation Committee and the Chief Executive Officer are responsible for applying the Policies and Procedures for Personal Use of Aircraft. Directors” in this Proxy Statement. •the name and address of the stockholder who intends to make the nomination and of the person or persons to be nominated; •a representation that the stockholder is a holder of record at the time of such notice and intends to be a holder of record on the record date for such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice; •a description of all arrangements or understandings between the stockholder and each nominee and any other person or persons (naming such person or persons) pursuant to which the nomination or nominations are to be made by the stockholder; •such other information regarding each nominee proposed by such stockholder as would have been required to be included in a proxy statement filed pursuant to the proxy rules of the SEC had the Board of Directors solicited proxies for the election of such nominee at the meeting; and •the consent of each nominee to serve as a director of ProAssurance if so elected. •a brief description of the business desired to be brought before the meeting and the reasons for considering such matter or matters at the meeting; •the name and address of the stockholder who intends to propose such matter or matters; •a representation that the stockholder has been a holder of record of stock of ProAssurance entitled to vote at such meeting for a period of one year and intends to hold such shares through the date of the meeting and appear in person or by proxy at such meeting to propose such matter or matters; •any material interest of the stockholder in such matter or matters; and •a description of all understandings or relationships between the stockholder and any other person(s) (naming such persons) with respect to the capital stock of ProAssurance as to the matter specified in the notice. attention through the EthicsPoint hotline. Further information on the procedure for these communications is available in the Corporate Governance section of our website at www.proassurancegroup.com. Plan.

meetingMeeting of Stockholders25, 201611, 2016.12, 2024. Our Board of Directors is soliciting your proxy to vote your shares at the annual meetingAnnual Meeting of ProAssurance’s stockholdersStockholders to be held at 9:00 a.m., Central Daylight Time, on Wednesday, May 25, 2016,22, 2024, in the Fifth Floor BoardroomO’Neil Multimedia Room of our headquarters located at 100 Brookwood Place, Birmingham, Alabama 35209, or at any adjournment or postponement thereof.three (3)four (4) members to the Board of Directors of ProAssurance as Class IIIII directors, to serve until the 2019 annual meeting, and to ratify the appointment of Ernst & Young LLP as independent auditors.auditors, and to approve the ProAssurance Corporation 2024 Equity Incentive Plan. Additionally, stockholders will be asked to cast an advisory vote on the approval of our executive compensation as disclosed in this proxy statement.2)3); and FOR the approval of the compensation of our named executive officers as disclosed in this proxy statement (Proposal 3)4).April 1, 2016March 25, 2024, as the record date for the annual meeting. You are entitled to notice of, and to vote at, the annual meeting if you ownowned shares as of the close of business on our record date.62,481,75763,260,704 issued shares of our common stock, par value $0.01 per share (“Common Stock”). Of that amount, we hold 9,158,4159,192,209 shares as treasury shares that cannot be voted at the meeting. You are entitled to one vote in person or by proxy on all matters properly to come before the annual meeting for each share of our Common Stock that you ownowned on the record date.

name?”name?”224, 2016. Submitting21, 2024. You will still have the right to vote in person at the meeting even if you submit your proxy via the internet or by telephone will not affect your right to vote in person should you decide to attend the annual meeting.20162024 Annual Meeting of Stockholders (the 20152023 Annual Report to the Stockholders, which includes our Annual Report on Form 10-K for the year ended December 31, 2015,2023, proxy statement and proxy card) are available on the internet at www.proxyvote.com. Our proxy statement and proxy card for the annual meeting and our 20152023 Annual Report also will be available through the “Investor Relations” section of our website at www.ProAssurance.comhttp://investor.ProAssurance.com/docs until at least May 24, 2017.22, 2025. Our Annual Report to the Stockholders and Annual Report on Form

20152023 Annual Report to the Stockholders and 20152023 Annual Report on Form 10-K (including the financial statements and financial statement schedules but without exhibits) without charge by contacting Frank B. O’NeilJeff Lisenby, Secretary, at our address shown above, by telephone at (205) 877-4400 or (800) 282-6242, or by e-mail at Investor@ProAssurance.com. Copies of exhibits to the Annual Report on Form 10-K will be provided upon specific request subject to a charge to cover the cost of producing the copies. You may also request a copy through www.proxyvote.com using your Control Number.www.ProAssurance.com. http://investor.ProAssurance.com/govdocs.and Code of Ethics and Conduct, and our Environmental and Social disclosures may be obtained by contacting Frank B. O’Neil, Senior Vice President,Jeff Lisenby, Secretary, ProAssurance Corporation, either by mail at P.O. Box 590009, Birmingham, Alabama 35259-0009, by telephone at (205) 877-4400 or (800) 282-6242 or by e-mail at Investor@ProAssurance.com.20162024 annual meeting. In addition to the solicitation of proxies by mail and the internet, solicitation may be made by certain of our directors, officers or employees telephonically, electronically or by other means of communication. We have not retained a proxy solicitor to assist in the solicitation of proxies, but if we decide to do so we will pay for the fees and other expenses of the solicitor.IIIII directors will expire at the 20162024 annual meeting. The Board of Directors has nominated Bruce D. Angiolillo, Esq.J.D., JohnRichard J. McMahon,Bielen, C.P.A., Samuel A. DiPiazza, Jr., Esq.C.P.A., and W. Stancil Starnes, Esq.Staci M. Pierce, J.D. for election to the Board of Directors at the 20162024 annual meeting as Class III directors.3AtII directors, to serve until the annual meeting you willin 2027.askeddivided into three classes as nearly equal as possible and that the directors serve staggered terms of three years. The remaining directors may fill any vacancies on the Board of Directors resulting from the death, resignation or removal of a director or from any increase in the number of directors.electreduce the following persons assize of the Board from 12 directors to 10 directors with the number of Class I and Class III directors each being reduced by one director as a result of the Company reclassifying Messrs. Angiolillo and Di Piazza as Class II directors.hold office for terms endingserve a term of three years expiring at our 2027 annual meeting and until their successors are duly elected and qualified. Two of the current nominees, Messrs. Angiolillo and Di Piazza, are presently members of our Board, having served on the Company's Board since 2014 and 2016, respectively. Messrs. Angiolillo and Di Piazza were each most recently elected to our Board by our stockholders at our 2023 and 2022 annual meeting of stockholders, to be held in 2019:Bruce D. Angiolillo, Esq. (Age 63) is a first time nominee to the Board of Directors. He is a retired partner of Simpson Thacher & Bartlett LLP, New York, New York. Mr. Angiolillo joined Simpson Thacher in 1980 and developed a practice in the areas of securities and other complex commercial litigation before his retirement on December 31, 2014. Following his retirement at Simpson Thacher, Mr. Angiolillo was employed from January 1, 2015 until June 30, 2015, as general counsel for TK Holdings, Inc., which is a subsidiary of Takata Corporation, a global automotive parts manufacturer and supplier based in Auburn Hills, Michigan.John J. McMahon, Jr., Esq. (Age 73) has served as a director of ProAssurance since February 2002. Mr. McMahon has served as Chairman of Ligon Industries, a manufacturer of waste water treatment equipment, aluminum castings and hydraulic cylinders, following his service as Chairman of the executive committee of McWane, Inc. in Birmingham, Alabama, from 1999 until December 31, 2005. Mr. McMahon formerly served as a director of Protective Life Corporation, a public insurance holding company until its sale in February 2015.W. Stancil Starnes, Esq. (Age 67) was elected to the Board of Directors on September 2007 and serves as its Chairman. Mr. Starnes was appointed as Chief Executive Officer of ProAssurance on July 2, 2007. Mr. Starnes currently serves as a director of Infinity Property and Casualty Corporation (NASDAQ: IPCC), a public insurance holding company based in Birmingham, Alabama, where he serves on the audit, compensation and executive committees. He serves as a director of National Commerce Corp. (NASDAQ: NCOM), a public bank holding company based in Birmingham, Alabama.

board’sBoard’s proxy card have advised us that, unless a contrary direction is indicated on your proxy card, they intend to vote the shares appointing them as proxies in favor of the named nominees. If the nominees should be unable to serve, and the Board of Directors knows of no reason to anticipate that this will occur, the persons named in the proxy card will vote for such other person or persons as may be recommended by our Nominating/Corporate Governance Committee and designated by the Board of Directors, or the Board of Directors may decide not to elect an additional person as a director. The persons named in the proxy card will have no authority to vote for the election of any person other than the nominees or their substitutes in the election of directors.his or hertheir election than votes “withheld” from such election. Our By-Laws provide that directors in contested elections are elected under a plurality vote standard in which nominees receiving the most votes are elected, regardless of how many shares are voted against the nominee. A contested election is one in which there are more nominees than directors to be elected. The election of directors pursuant to this Proposal 1 is an uncontested election.majority votingelection of directors.As a result, if you hold your shares in “street name” with your broker and you do not specificallyinstruct your broker how to vote on the election of the directors, your broker will not vote for you on Proposal 1 (election(Election of directors)Directors), Proposal 2 (Approval of the ProAssurance Corporation 2024 Equity Incentive Plan), or Proposal 4 (Advisory Vote on Executive Compensation).The vote required for Proposal 1 (election of directors) is a majority of the votes present in person or by proxy at the meeting and entitled to vote on the proposal, with “majority” meaning that the number of shares voted “for” a director’s election exceeds the number of shares voted “against” such director’s election. The vote required for Proposal 2 (Approval on the 2024 Equity Incentive Plan) is a majority of the votes present in person or by proxy at the meeting and entitled to vote on the proposal, with "majority" meaning that the number of shares voted "for" approval of the 2024 Equity Incentive Plan exceeds the number of shares voted "against" approval of the 2024 Equity Incentive Plan. The vote required for Proposal 4 (Advisory Vote on Executive Compensation) is a majority of the votes present in person or by proxy at the meeting and entitled to vote on the proposal, with “majority” meaning that the number of shares voted “for” approval of the proposed executive compensation exceeds the number of shares voted “against” such executive compensation. The Board of Directors will consider the stockholders' vote on an advisory basis.proposal.4tentwelve directors.John J . McMahon,J.D., Richard J. Bielen, C.P.A., Samuel A. DiPiazza, Jr., C.P.A., and W. Stancil StarnesStaci M. Pierce, J.D. for election to the Board of Directors at the 20162024 annual meeting as Class IIIII directors as set forth above under the caption “Proposal 1 — Election of Directors.” Messrs. McMahon and Starnes are currently Class III directors whose terms will expire at the annual meeting. Mr. Angiolillo has been nominated to succeed Dr. William J. Listwan whose term as a Class III Director will expire at the annual meeting and who will retire from the Board of Directors because of age requirements in our Bylaws. Information regarding the nominees is set forth above and information regarding the directors continuing in office is set forth below, all of which was confirmed by them for inclusion in this proxy statement. Information regarding stock ownership by the nominees and continuing directors is set forth in the table under the caption “Beneficial Ownership of Our Common Stock” included elsewhere in this proxy statement.IIII Directors Continuing Continuing in Office — Term Expiring in 2017Samuel A. Di Piazza, Jr.(Age 65) has served as a director of ProAssurance since January 2014. Mr. Di Piazza is a member of the Board of Trustees of Mayo Clinic and was appointed its Chairman in February 2014. Mr. Di Piazza served as Vice Chairman of the Institutional Clients Group of Citibank from 2011 until his retirement from Citibank in February 2014. Prior to his service with Citibank, Mr. Di Piazza was a partner with5PricewaterhouseCoopers LLP (and its predecessor, Coopers & Lybrand) for thirty years. Mr. Di Piazza currently serves as a director for AT&T Inc. (NYSE:T) (and for DIRECTV prior to its merger with AT&T) and Jones Lang Lasalle, Inc. (NYSE:JLL); and formerly served as a director of Apollo Education Group, Inc. (NASDAQ:APOL).Robert E. Flowers, M.D. (Age 66) has served as a director of ProAssurance since June 2001 and became our lead director in May 2012. Prior to June 2001, Dr. Flowers served as a director of our insurance subsidiary, ProAssurance Indemnity Company, Inc. (formerly, The Medical Assurance Company, Inc.) from 1985 to 2001, and as a director of its former holding company, Medical Assurance, Inc. (1995-2001). Dr. Flowers practiced as a physician with Gynecology Associates of Dothan P.C., Dothan, Alabama, prior to his retirement in 2001.Ann F. Putallaz, Ph.D. (Age 70) has served as a director of ProAssurance since June 2001. Prior to 2001, Ms. Putallaz served as a director of our predecessor, Professionals Group, Inc. (1996-2001), and as its Vice-Chairman (1999-2001). Ms. Putallaz received her Ph.D. in economics in 1974 and has served in various capacities for firms engaged in the investment management business since 1983. Ms. Putallaz is currently Principal of AFP Consulting, LLC. She retired from Munder Capital Management, an investment advisor to The Munder Funds, an open end investment company registered under the Investment Company Act of 1940 where she served as Director of Data & Communication Services.

III Directors Continuing Continuing in Office — Term Expiring in 2018M. James Gorrie(Age 53) has served as a director of ProAssurance since May 2012. Mr. Gorrie is the President and Chief Executive Officer of Brasfield & Gorrie, Inc. in Birmingham, Alabama, a construction firm with recent annual revenues in excess of $2 billion. He holds a B.S. in Building Science from Auburn University and serves as a Director of First Commercial Bank (a division of Synovus Bank, one of the largest community banks in the Southeast) and Energen Corporation (NYSE: EGN) in Birmingham, a public oil and gas exploration and production company.Frank A. Spinosa, D.P.M. (Age 61) has served as a director of ProAssurance since May 2012. Dr. Spinosa is a board-certified podiatrist and has practiced as a partner of Shelter Island Podiatry Associates in Shelter Island, New York. Dr. Spinosa served as a member of the Board of Trustees of the American Podiatric Medical Association through March 2016. Dr. Spinosa is also a past president of the American Podiatric Medical Association and a past president of the New York State Podiatric Medical Association. He has taught as an Associate Professor of Radiology at the New York College of Podiatric Medicine.Ziad R. Haydar, M.D. (Age 53) has served as a director of ProAssurance since May 2015. He is Senior Vice President and Chief Clinical Officer of Ascension Health in St. Louis Missouri. Ascension Health is the largest not-for-profit and largest Catholic health system in the United States. Dr. Haydar began his tenure at Ascension Health in 2010 as its Vice President Clinical Excellence and Physician Integration until he was promoted to Vice President and Chief Medical Officer in 2011 until his appointment to his current position in July 2015. Prior to 2010, Dr. Haydar was an executive with Baylor Health Care System in Dallas Texas. Dr. Haydar received his M.D. degree from American University in Beirut, trained in Family Medicine at the Medical University of South Carolina, and completed a fellowship in Geriatrics and Gerontology at Johns Hopkins University School of Medicine.Thomas A. S. Wilson, Jr., M.D.(Age 54) has served as a director of ProAssurance since May 2012. Dr. Wilson is a board-certified neurosurgeon with Neurosurgical Associates, P.C., in Birmingham, Alabama. He holds a B.S. in natural science and mathematics from Washington & Lee University and an M.D. from Vanderbilt University. He completed an internship in general surgery and a residency in neurosurgery at Bowman Gray School of Medicine, Wake Forest University.

Kedrick D. Adkins Jr., C.P.A. Ziad R. Haydar, M.D. Bruce D. Angiolillo, J.D. Frank A. Spinosa, D.P.M. Fabiola Cobarrubias, M.D. Scott C. Syphax Samuel A. Di Piazza, Jr., C.P.A. John J. McMahon, Jr.Katisha T. Vance, M.D.Robert E. Flowers, M.D.Maye Head FreiAnn F. Putallaz, Ph.D.M. James GorrieFrank A. Spinosa, D.P.M.Ziad R. Haydar, M.D.Thomas A. S. Wilson, Jr., M.D. William J. Listwan, M.D.M. James GorrieBruce D. Angiolillo,Staci M. Pierce and Richard J. Bielen, if elected at the annual meeting, will each be an independent director. In 2015, the Board of Directors determined that Anthony R. Tersigni was independent during his service on the Board of Directors and Audit Committee prior to the election of his successor at the 2015 annual meeting.Since 2012, ourthatthe other company’s consolidated gross revenues during each fiscal year ended in such period.Anthony R. Tersigni, EdD, FACHE is the President and Chief Executive officer of Ascension Health Alliance or Ascension. Ascension is the parent holding company for Ascension Health (“AH”) and Ascension Health Insurance, Ltd. (“AHIL”). Ziad R. Haydar, M.D. is Senior Vice President and Chief Clinical Officer of AH. Effective January 1, 2011, ProAssurance entered into a Program Agreement with AH (the “Program”) pursuant to which a branded joint insurance program was created to insure the professional liability of certain physicians and healthcare providers affiliated with the Ascension health system, which is comprised of over 100 non-profit hospitals and other healthcare providers (the “System”). The Program, marketed under the name “Certitude®,” is administered and underwritten by ProAssurance’s insurance subsidiaries. Policies issued under the Program are reinsured by AHIL. In 2013, 2014 and 2015, ProAssurance’s insurance subsidiaries wrote premiums through the Program in the amount of $22,427,745, $25,775,624 and $30,781,333 respectively, of which $5,136,372, $8,002,392 and $8,489,894 respectively, was paid by Ascension affiliates on behalf of the physicians. ProAssurance paid a reinsurance premium to AHIL in the amount of $12,089,305 in 2013, $14,390,619 in 2014, and $16,323,034 in 2015, and AHIL paid to ProAssurance a ceding commission of $1,905,981 in 2013, $1,938,507 in 2014, and $2,177,930 in 2015. In 2015, AHIL also paid a subsidiary of ProAssurance a ceded premium of $483,431 under a reinsurance treaty that provides a buffer layer for excess professional liability insurance written by AHIL. The Board found that Dr. Haydar is not precluded from being independent because the amount of payments to and from ProAssurance was significantly below the two percent (2%) of the consolidated revenues of Ascension and thereby did not meet the “bright line” tests for independence under the NYSE Rules. Furthermore, the Board found that Dr. Haydar is not precluded from being independent7under the Governance Guidelines, which prohibit any material transaction relationship using the same thresholds applied solely to the recipient of the payments, because the payments actually made by Ascension on behalf of physicians and providers are less than 2% of our revenues in 2015. Based on these determinations, the Board found Dr. Haydar to be an independent director.Frank A. Spinosa, D.P.M., is a member of the Board of Trustees of the American Podiatric Medical Association (the “Association”) and served as its President for the year that ended March 23, 2015. Dr. Spinosa is not and has not been an employee of the Association, but he received an honorarium in the amount of $159,500 for his services as President of the Association, all of which was paid in 2014. The Association and ProAssurance’s subsidiary, Podiatry Insurance Company of America (“PICA”), are parties to a License Agreement effective March 1, 2011 (the “License Agreement”), pursuant to which PICA is required to pay the Association $100,000 per annum for the Association’s endorsement of PICA’s medical professional liability insurance and for the right to use the Association’s name, logo and member list in marketing the endorsed products. PICA has also agreed to pay at least $25,000 per annum in support of the Annual Scientific Meeting; to provide a PICA Risk Management Program at such meeting; and to provide a premium discount to PICA insured podiatric physicians who attend the Risk Management Program. Finally, PICA has agreed to support the Association’s Young Member Program at the rate of $174,000 per annum. In 2013, 2014 and 2015, PICA paid the Association $446,250, $505,175 and $290,000 respectively, pursuant to the License Agreement and as miscellaneous donations. The current budget for the Association contemplates annual revenues of approximately $13.8 million. Based on these amounts, the Board found that Dr. Spinosa was not precluded from being independent under NYSE Rules because the payments to and from ProAssurance in the last three years were below the threshold of $1,000,000. Furthermore, the Board found that Dr. Spinosa is not precluded from being independent based on its understanding of the Governance Guidelines, which prohibit any material transaction relationship using the same thresholds applied solely to the recipient of the payments. In addition, we have had discussions with ISS about these payments to the Association and their historical context and importance to the business of PICA, and we were advised that ISS considers these payments transactional in nature so that they should not preclude a finding that Dr. Spinosa is independent.Listwan, Spinosa, Vance, and Wilson), and Dr. Spinosa’s spouse is a physician insured by the Company. Dr. Listwan purchased insurance from the Company until December 31, 2013, and he paid premiums of less than $3,000 in 2013.Cobarrubias). Dr. Spinosa and his spouse have purchased individual policies of medical professional liability insurance from PICAan insurance subsidiary of ProAssurance during the last three years as follows: 2013-20142021/22 — $2,341; 2022/23 — $1,612; and 2023/24 — none. Dr. Spinosa $5,052 and spouse $7,352; 2014-2015 — Dr. Spinosa $8,024 and spouse $7,978; 2015-2016 — Dr. Spinosa $8,266 and spouse $8,266. Dr. WilsonVance purchased individual policies ofpersonal medical professional liability insurance from an insurance subsidiary of ProAssurance in each of the last three years as follows: 2013-20142021 — $47,993; 2014-2015$9,407; 2022 — $47,993;$9,757; and 2015-20162023 — $42, 274.$18,584. Dr. WilsonVance is also an executive officera partner of Neurosurgical Associates, P.C.,Alabama Oncology, which is insured by one of ProAssurance’s insurance subsidiaries with a current premiumfor the following amounts: 2021-2022 — $333,374 ; 2022-2023 — $345,574; and 2023-2024 — $368,860. Dr. Cobarrubias purchased personal medical professional liability insurance from an insurance subsidiary of approximately $134,383.ProAssurance in 2021 in the amount of $537. Additionally, Dr. Cobarrubias is the Chief Executive Officer of Patient Inpatient Medical Group, which purchased medical professional liability insurance from an insurance subsidiary of ProAssurance for the following amounts: 2021-2022 — $182,579; 2022-2023 — $225,784; and 2023-2024 — $285,601. All insurance policies were obtained in the ordinary course of business at rates that are consistent with our filed rates and customary underwriting practices. The premiums paid with respect to the individual physicians or the practice entities do not exceed the lowerapplicable $1,000,000 standard of materiality set forth in the NYSE Rules. President and Chief Executive Officer of Brasfield & Gorrie, L.L.C. (“B&G”). B&G is a controlling60% member of Hangar 24, LLC, (“Hangar 24”) of which ProAssurance owns 20% and B&G owns 60%.8The sole purpose of Hangar 24 is to share the cost of thehas leased a hangar leased from the Birmingham Airport Authority whereto house the aircraft of its members. ProAssurance keeps its corporate aircraft.is a 20% member of Hangar 24, pays the rent on the hangar.LLC and an unrelated third party is a 20% member. ProAssurance reimburses Hangar 24, LLC directly for its share of the rent and reimburses Hangar 24 for the cost of the fuel used by its aircraft.aircraft and for its percentage share of the rental payments on the lease of the hangar. ProAssurance paid Hangar 24, LLC $97,915 for fuel reimbursement and rent in 2021, $125,528 for fuel reimbursement and rent in 2022, and $131,013 for fuel reimbursement and rent in 2023. The Board of Directors determined that this relationship did not preclude Mr. Gorrie’s independence because the amounts paid for rent and fuel reimbursement do not exceed the greater of $1,000,000 or 2% of the recipient’s gross revenues and it doesdo not meet the materiality threshold for “material transactions” under the Governance Guidelines.Mr. McMahon is an executive officer and a controlling stockholder of Ligon Industries (“Ligon”). Ligon and ProAssurance (through their subsidiaries) are parties to an Aircraft Interchange Agreement dated April 5, 2012. Pursuant to this agreement, ProAssurance has the right to use the Ligon aircraft at its election on the condition that ProAssurance allows Ligon to use the ProAssurance aircraft for the same amount of time. that this relationship did not preclude Mr. McMahon’s independence because the value of the exchange between Ligon and ProAssurance did not exceed the greater of $1,000,000 or 2% of the recipient’s gross revenues and it does not meet the materiality threshold for “material transactions” under the Governance Guidelines.The Board of Directors has determined that the relationship between Ascension and ProAssurance did not impair the independence of either Dr. Tersigni or Dr. Haydar; the relationship between PICA and the American Podiatric Medical Association did not impair the independence of Dr. Spinosa; that the purchase of medical professional liability insurance by our directors and their relativesrespective practices did not impair the independence of Drs. Listwan, Spinosa, Vance, and Wilson; thatCobarrubias; and the relationship between ProAssurance and B&G did not impair the independence of Mr. Gorrie; and that the relationship between ProAssurance and Ligon did not impair the independenceGorrie.Mr. McMahon.The NYSE rules provide that a director cannot be independent if he or she, or an immediate family member of such director, has received compensation (other than director and committee compensation) during any 12-month period of more than $120,000 from, ProAssurance or any of its subsidiaries in any of the last three years.Dr. Spinosa’s spouse has served on the physicians’ committee of PICA and received compensation and reimbursement of expenses from PICA in the following amounts during the last three years: 2013 — $14,215 (including $4,751 for reimbursement of expenses), 2014 — $15,548 (including $5,648 for reimbursement of expenses), and 2015 — $3,648 (including $2,148 reimbursement of expenses). Dr. Spinosa did not receive any compensation from PICA or any other subsidiary of ProAssurance during this period. The Board determined that the payments to Dr. Spinosa’s spouse did not impair his independence because the amount of the fees did not exceed the $120,000 threshold and because his spouse is not dependent on PICA for her primary source of compensation. The Board also determined that payments made to Dr. Spinosa’s spouse in 2015 should not violate the Governance Guidelines which prohibit compensation for “professional services” in excess of $10,000 per year to a director’s spouse.We have engaged Dr. Listwan as a consultant under a Consulting and Confidentiality Agreement that provides that Dr. Listwan will provide nonexclusive services to ProAssurance relating to review of insurance cases, facilitating ProAssurance’s relationship with the Wisconsin Medical Society, providing consultation services with respect to claims, underwriting, and risk management, and providing other services as requested in consideration of an annual retainer of $44,000. At its meeting on December 2, 2015, the Board of Directors reviewed this consulting arrangement and determined that Dr. Listwan satisfies the current independence criteria for directors because: (i) Dr. Listwan is not an employee of ProAssurance or any of its subsidiaries based on the Board’s review of the terms of Dr. Listwan’s engagement as a consultant and its consideration of Internal Revenue Service regulations defining employees and independent contractors for purposes of FICA (Federal Insurance Contributions Act) withholding, and the factors used by our Human Resources Department to determine whether a service provider receives a statement on Form W-2 (an employee) or Form 1099 (independent contractor) with respect to its compensation for services; and (ii) the compensation payable to Dr. Listwan for services as a consultant would not exceed the limitation on non-director compensation under the NYSE Rules. Based on the above analysis, the Board of Directors determined that Dr. Listwan should be9considered an independent director under the NYSE Rules notwithstanding the Governance Guidelines, which provide that a director will be deemed an “Affiliated Outside Director” if he or she receives compensation in excess of $10,000 for “professional services.”The Board of Directors has determined that the payment of consulting fees to Dr. Spinosa’s spouse and Dr. Listwan should not impair the independence of Drs. Spinosa and Listwan.Other Relationships Considered.Piazza’sPiazza, and Dr. Putallaz’sCobarrubias serve on the Audit Committee. Mr. Adkins’ and Mr. Di Piazza’s only relationship with the Company is their service on the Board and the Audit Committee. The Board of Directors also carefully evaluated the independence ofIn reviewing Dr. Tersigni and his successorCobarrubias’ qualifications to serve on the Audit Committee, Dr. Spinosa, with respect to the above described relationshipsBoard evaluated the above-described relationship as required by the NYSE and SEC Rules. The Board determined that such relationships shouldthe existence of this relationship did not impairpreclude Dr. Cobarrubias fromability of either of them to be independentAudit Committee under the NYSE and SEC standardsrequirements for members of the Audit Committee.audit committee members. As a result, the Board determined that each of these directors was permitted to serve on the Audit Committee under the requirements of the SEC and NYSE rules.Flowers, Mr. McMahonHaydar, and Mr. GorrieSyphax serve on the Compensation Committee. Dr. Flowers’The only relationship each of them has with the Company is histheir service on the Board and as Lead Director and a membermembers of the Compensation Committee. As a result, the Board determined that Dr. Flowers was permittedHaydar, Mr. Syphax, and Ms. Frei were eligible to serve on the Compensation Committee under the requirements of the SEC rules. In reviewing Mr. McMahon’s and Mr. Gorrie’s qualifications to serve on the Compensation Committee, the Board evaluated the above described relationships as required by the NYSE Rules mandated by SEC Rule 10C-1. The Board determined that the existence of these relationships did not impact the ability of either Mr. McMahon or Mr. Gorrie to satisfy his objectivity in the boardroom or ability to satisfy his fiduciary duty to the Company’s stockholders under the NYSE Rules, as well as under the Governance Guidelines.inand diversity the compositionviewpoints, background, experience, and other demographics of the Board.its products.the products and services we offer. More specifically:particularly businesses in the insurance and financial services sectors, and withincluding experience in the governance of publicly traded companies.toWe Protect Others, informed by our Guiding Principle of “Treated Fairly.Fairly®.” Those values are integrity, leadership, relationships, and enthusiasm.10ProvidersProviders/Healthcare Experience: Our Board currently hasPresently, five physicians who are independent directors: Robert Flowers,directors on our Board: Fabiola Cobarrubias, M.D., Ziad R Haydar, M.D., William Listwan, M.D., Frank Spinosa, D.P.M., Katisha T. Vance, M.D., and Thomas A.S. Wilson, Jr., M.D. EachDr. Cobarrubias serves as a hospitalist for California Pacific Medical Center and is the Chief Executive Officer of our physician-directors is board certified in a different medical specialty and actively practices medicine, with the exception of Dr. Flowers, who retired from his obstetrics and gynecology practice in Dothan, Alabama, after more than 20 years andPacific Inpatient Medical Group. Dr. Haydar who is onserved as the management termChief Clinical Officer of Ascension Health as itsuntil June 2019 and is currently the Chief Clinical Officer.Medical Officer of Alpine Physician Partners. Dr. Listwan, who has practiced internal medicineSpinosa is currently a board-certified podiatrist affiliated with First Nations Community Healthsource clinic in Wisconsin for over 30 years,Albuquerque, New Mexico. Dr. Spinosa served as a boardBoard member of New Mexico Podiatric Medical Association and President of the Wisconsin Medical Society and is currently on the volunteer faculty of the Medical College of Wisconsin in Milwaukee and employed as a part-time Medical Director for Molina Health Care. Dr. Spinosaformerly served as a board member and is a past president of the American Podiatric Medical Association. Dr. Spinosa is also a past President of the New York State Podiatric Medical Association, and has taught at the New York CollectionCollege of Podiatric Medicine.Medicine along with serving as a Faculty Fellow in podiatric medicine at the Royal College of Physicians and Surgeons, Glasgow. Dr. WilsonVance is a board-certified oncologist and hematologist practicing at Birmingham Hematology and Oncology (d/b/a Alabama Oncology) in Birmingham, Alabama. She has served as the President of the Jefferson County Medical Society. Dr. Wilson was a board-certified neurosurgeon who has been in practiceand practiced for over 20 years prior to his retirement in 2019 and has authored numerous publications and presentations. presence of our independent physician-directors reflectsreflect our commitment to local market presence and to our physician heritage. Dr. Flowers has served on our regional claims committee in Alabama for over 20 years. Dr. Listwan served on the board and claims committee of our Wisconsin predecessor from 1980 until its merger with ProAssurance in 2006. These physicians regularly attend regional claims committee meetings and assist the Board of Directors in understanding professional liability and risk management issues affecting and of concern to physicians and other healthcare professionals in our professional liability insurance markets.Dr. Haydar brings valuable healthcare and business knowledge to the Board of Directors. Dr. Haydar is a Senior Vice-President and Chief Clinical Officer of Ascension Health, which is the largest not-for-profit, and largest Catholic health system in the United States. Dr. Haydar leads Ascension’s Clinical Excellence initiatives directed at patient safety within the organization.In addition to our physician directors, our Chief Executive Officer, W. Stancil Starnes, represented practicing physicians in the defense of medical malpractice claims for over 30 years. Mr. Starnes brings to the Board a deep understanding of the legal and professional issues involved in resolving claims and how best to deliver the claims defense that is the key component of our insurance products. has, C.P.A., served on the Board of Trustees of Mayo Clinic sincefrom 2010 to 2022 and was appointedits Chairman of the Board of Trustees onfrom February 21, 2014.2014 to February 2021. Mayo Clinic is a nonprofit worldwide leader in medical care, research and education. The Board of Trustees is the governing body of Mayo Clinic and has overall responsibility for the charitable, clinical practice, scientific and educational mission and purposes of Mayo Clinic.Starnes hasRand served as ourChief Financial Officer of ProAssurance from 2004 to 2018, and President and Chief Operating Officer from 2018 until his appointment as Chief Executive Officer sincein July 2007,2019. He was elected to the Board after his appointment as President. Mr. Rand also brings his considerable financial and it has been our practice for our Chief Executive Officerbusiness knowledge to serve on ourthe Board of Directors.Starnes is a director of Infinity PropertyAdkins, in addition to serving in executive and Casualty Corporation, a public insurance holding company, and National Commerce Corporation, a public bank holding company.Mr. McMahon was a director of Protective Life Corporation, which was a public insurance holding company until its sale in February 2015. Mr. McMahon’s career has focused on the leadership of business enterprises including McWane Cast Iron Pipe Company, a privately held manufacturer of cast iron pipe, and Ligon Industries, a manufacturer of waste treatment equipment, aluminum castings and hydraulic cylinders. His leadership ability is reflected by his election to serve as a trustee of the University of Alabama, a director of UAB Health Systems, and a trustee of Birmingham Southern College.Dr. Putallaz, who obtained a Ph.D. in economics in 1974, has served in various capacities for firms engagedfinancial roles in the investmenthealthcare community, had a 30-year tenure at Accenture, a global management business since 1983. Prior to that time she was a lecturer in the Economics Department of the University of Michigan. She currently serves in a volunteer capacity for the CFA Institute, working on initiatives related to the Global Investment Performance Standards® or GIPS®. In that capacity, she chairs the GIPS® Executive Committee. Ms. Putallaz, who serves on our Audit Committee,consulting and professional services firm. He brings herhis knowledge and expertise to the financial and investment aspects of ProAssurance.11Mr. Gorrie also valuable business perspective to the Board of Directors. Mr. Gorrie isDirectors a wealth of business knowledge that benefits ProAssurance. Until its sale in December 2021, Ms. Frei served as the President and Chief Executive OfficerChairman of BrasfieldRam Tool & Gorrie,Supply Company, a multi-state construction firm with recent annual revenues in excess of $2 billion.QualificationsQualifications: In selecting individual candidates, ProAssurance also has considered other relevant experience of our directors including:Practice of Law: A background in law is of significant value in understanding the legal issues impacting ProAssurance as a publicly traded company and as a holding company for regulated insurance companies. Messrs. McMahon and Starnes both had experience in the private practice of law prior to entering their business careers. Mr. Starnes served as senior and managing partner of the law firm of Starnes & Atchison LLP in Birmingham, Alabama, where he was extensively involved with ProAssurance and its predecessors in the defense of medical liability claims for over 25 years. Mr. Angiolillo was a partner at Simpson, Thacher & Bartlett LLP in New York for approximately 30 years until his retirement in 2014 where his practice involved securities and other complex commercial litigation.McMahon, Starnes, Di Piazza, Gorrie, and GorrieAdkins have all served, or currently serve, as members of the Board of Directors of one or more publicly traded companies, and each has gained valuable experience through leadership of, and service on, various standing committees of each Board on which they have served.Dr. Putallaz and Dr. SpinosaCobarrubias meet the financial literacy requirements as a resultbecause of their training, employment, and general financial expertise. Mr. Di PiazzaAdkins has been designated as our audit committee financial expert based upon his expertise and his experience in accounting and experience from his leadership positions at PricewaterhouseCooopers LLP. In addition to his positions at PricewaterhouseCoopers, Mr. Di Piazza has served as a trustee of the London based International Financial Reporting Standards FoundationMayo Clinic and a trustee of the US based Financial Accountancy Foundation.Diversity: elsewhere.geographic representation.gender. As vacancies arise on our Board, we consider diversity as a factor in the selection of a new director.Independent Board Members Tenure* Gender* Race/Ethnicity Age* 12 Male White 69 12 Male White 62 12 Male White 63 10 Male White 73 9 Male White 63 8 Male White 71 7 Female African American 49 6 Male African American 71 5 Female White 53 3 Male African American 60 3 Female Latina 57 Ourhas determined that it is in our best interest forelected Mr. StarnesAngiolillo to serve as our Chairman of the Board and our Chief Executive Officer. Our Board believes it is in our best interest to have one individual to lead our company and to establish its strategic goals and objectives under the supervision and direction of the Board of Directors. Our Board also believes that having Mr. Starnes serve as our Chairman and Chief Executive Officer facilitates his ability to establish priorities for our Board and management in achieving such goals and objectives.12In December 2011, we formally establishedAs independent Chairman, Mr. Angiolillo presides at executive sessions, and the position of lead director to preside at each executive session. At the annual meeting inBoard has not selected a Lead Independent Director since May 2015, the independent directors selected Dr. Flowers as the independent director to preside at the executive sessions.2022. During 2015,2023, our independent directors held an executive session after each quarterly Board meeting.is principally conducted bythrough insurance subsidiaries that are subject to insurance laws and regulations in their respective domiciliary states and in the states in which they do business. State insurance regulatory regimes are intended to protect policyholders by vesting in the insurance regulator administrative and supervisory authority to address risks relating to the solvency of insurers and their ability to pay claims as well as to the marketing of insurance products and rates charged for such products. The insurance regulations identify key business risks associated with the insurance business and provide guidance as to the management of these risks. In addition, many states have adopted laws recommended by the NAIC has recently recommended that the states adopt new laws to require the assessment and reporting of risks associated with current and future business plans for insurers and their holding companies.have taken stepscontinuously work to catalogueidentify and identifyevaluate these and additional risks for purposes ofthrough our ongoing enterprise risk management (ERM).(“ERM”) processes. Our Chief Executive Officer is in charge ofresponsible for risk oversight. We have also established a risk management framework that recognizesoversight at the enterprise level. Our ERM process broadly addresses the risks inherent in our operating segments as well as the risks associated with the operations of our holding company.company, including short-, intermediate-, and long-term risks. The risk management process is managed by an ERM Committee comprisedcorporate executives in each line of personsbusiness who are responsible for our key risk areas, including but not limited to adequacy of loss reserves; defense of claims and the litigation process; the quality of investments supporting our reserves and capital; compliance with regulatory and financial reporting requirements; and concentration in our insurance lines of business.business; and information privacy and data security. Our Chief Executive Officer and ERM Committeemembers of executive management are responsible for identifying material risks associated with these and other risk areas and for establishing and monitoring risk management solutions that address levels of risk appetite and risk tolerance that are recommended by the committeemanagement as necessary and reviewed by the Board.functioning. The Board has divided primary ERM oversight responsibility between the Audit Committeefunctioning, and the Nominating/Corporate Governance Committee as follows:The Audit Committee has the primary oversight responsibility for risks relating to financial reporting and compliance. From time to time the Board receives input from external advisors or experts regarding emerging or increasing risk trends that are relevant to the Company and its business.established linestoday and into the future on society and the environment. We are attentive to the environmental and societal effects of communication between the Audit Committeematerials we use in our daily operations, the systems we use to efficiently serve our customers, and our independent auditor, internal auditor and management that enable the Audit Committee to perform its oversight function.The Nominating/Corporate Governance Committee has the primary responsibility forfacilities management. Our Board engages in active oversight of thosesuch effects and impacts and has implemented, and continues to implement, policies and procedures to address the societal and environmental effects of our operations and business activities.covered byon our operations, and the ERMeffect of our operations on the environment. Through this process, we have concluded that climate change and other potential environmental risks do not pose any material risk to our operations or financial results. Moreover, we have concluded that our business operations do not materially contribute to climate change or present any other material risk to the environment. The factors we considered in reaching these conclusions include but are not limited to:responsibilityprofessional liability of the Audit Committee. The Nominating/Corporate Governance Committee reviewsmedical professionals that we insure.ERM process established by management’s ERM Committee and monitorsproducts liability risk of life sciences manufacturers that we insure.functioninglikelihood of workplace injuries for employers that we insure.process. It also reviews recommendationsmajority of our ERM Committeeteam members are either fully-remote or working in a flexible work arrangement that supports healthy work-life balance and reduces carbon emissions associated with commuting to work while capitalizing on opportunities to bring team members together to foster relationships, fuel innovation and facilitate engagement.to materiality thresholdswell as educational and charitable organizations within the industry. For instance, all of our team members receive two paid days off that may be used for risks coveredcharitable or volunteer work. In 2023, our team members contributed 3,411 hours (455 work days) in support of charitable organizations in the ERM processcommunities where we operate. Moreover, we pride ourselves on offering a competitive compensation package to all our employees.asinclusion, human rights, and health and safety, please go to the levelsCorporate Responsibility section of risk appetite and risk tolerance with respect to covered risks.our website, https://investor.proassurance.com/corporate-responsibility/default.aspx.2015.2023. Our By-Laws establish four standing committees of the Board of Directors: the Nominating/Corporate Governance Committee; the Compensation Committee; the Audit Committee; and the Executive Committee, each of which is described below. Each of our incumbent directors attended all of the meetings of the Board of Directors and at least 75% of all of the meetings of the committees of the board on which he or she served during 20152023 (in each case, which were held during the period for which he or she was a director).1327. 2015.www.ProAssurance.com.http://investor.ProAssurance.com/govdocs. The primary purposes of the Nominating/Corporate Governance Committee are to:risks covered by ProAssurance’s ERM process that are not the responsibilitybusiness of the Audit Committee;Company; andHowever, theThe committee did not hire any search firm during 20152023, and, accordingly,therefore, paid no fees to any such company.inand diversify the compositionviewpoints, background, experience, and other demographics of the Board.14John J. McMahon, Jr. (Chairman)Katisha T. Vance, M.D. (Chair), Ziad R. Haydar, M.D.,M. James Gorrie, Frank A.2015,2023, our Nominating/Corporate Governance Committee met three times.www.ProAssurance.com.http://investor.ProAssurance.com/govdocs. The primary purposes of the Compensation Committee are to:2322 of this proxy statement. relevant to the Chief Executive Officer’s compensation as approved by the committee. The charter also charges the Compensation Committee with the responsibility to among other duties, review the competitiveness of the executive compensation programs of ProAssurance; approve change of control agreements or severance plans for executive officers of ProAssurance; administer the policy for the recoupment of unearned incentive compensation based on financial statements required to be restated; and make recommendations for director compensation to our Board of Directors. The charter further provides that the Compensation Committee has the exclusive authority to retain outside compensation consultants and advisors as it deems appropriate to fulfill its responsibilities in accordance with the NYSE Rules and SEC Rule 10C-1. In selecting a compensation consultant, the Compensation Committee must consider the six independence factors set forth by the NYSE, as further discussed in “Executive Compensation — Compensation Discussion and Analysis” beginning on page 2322 of this proxy statement.The of the Compensation Committee is to retainretains an outside consultant from time to time to gather data from peer companies and to use suchuses that data as a point of reference when reviewing ProAssurance’s compensation practices. The Compensation Committee, with the assistance of ProAssurance’s management and15its the independent consultant, identifies the peer companies to be used in the compensation analysis. The peer companies arehistorically have been publicly held property and casualty specialty insurance organizations that are comparable to ProAssurance in total assets, market capitalization, revenues and operating margin.2015,2023, our Compensation Committee met twofour times. The charter of the Compensation Committee provides for at least three members, each of whom must be (1) an independent director (1) within the meaning of NYSE Rules, including, but not limited to the independence factors set forth inmandated by SEC Rule 10C-1(b), (2) a “non-employee director” within the meaning of SEC Rule 16b-3, and (3) an “outside director” within the meaning of the regulations under Section 162(m) of the Internal Revenue Code. The current members of the Compensation Committee are Robert E. Flowers,Maye Head Frei (Chair), Ziad R. Haydar, M.D. (Chairman), M. James Gorrie and John J. McMahon, Jr.Scott C. Syphax. Our Board of Directors has determined that each member of the Compensation Committee is “independent” and meets the requirements of the Compensation Committee charter. No member of the Compensation Committee has any interlocking relationships required to be disclosed under federal securities laws.3431 of this proxy statement.www.ProAssurance.com.http://investor.ProAssurance.com/govdocs. The primary purposes of our Audit Committee are to represent and assist the Board of Directors in discharging its oversight responsibility relating to:162021 of this proxy statement as required by the SEC rules. is the Chairman,, C.P.A., and Ann F. Putallaz, Ph.D. and Frank Spinosa, D.P.M. are the other members of our Audit Committee.Fabiola Cobarrubias, M.D. Our Nominating/Corporate Governance Committee and our Board of Directors have determined that each member of the Audit Committee is “independent” within the meaning of the rules of both the SEC and NYSE; that each member of the Audit Committee is financially literate as such qualification is defined under the rules of the NYSE; and that Samuel A. Di Piazza, Jr.Mr. Adkins is an “audit committee financial expert” within the meaning of the rules of the SEC. Dr. Spinosa and Dr. Putallaz areCobarrubias does not presently servingserve on the audit committee of another company. Mr. Adkins is currently on the audit committee of Bright Health Group, Inc. and Mr. Di Piazza is currently on the audit committee of AT&T, Inc.2015,2023, the Audit Committee met teneight times.W. Stancil StarnesBruce D. Angiolillo (Chairman), Robert E Flowers, M.D.Samuel A. Di Piazza, Jr., C.P.A. (Vice Chairman), and John J. McMahon,Edward L. Rand, Jr. The Executive Committee did not meet in 2015.17Plan Category Number of Securities to be issued upon exercise of Outstanding Options, Warrants and Rights Weighted Average Exercise Price of Outstanding Options, Warrants and Rights Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (Excluding securities reflected in column (a)) (a) (b) (c) Equity compensation plans approved by security holders 1,212,545 $— — Equity compensation plans not approved by security holders — — — 2016.2024. Although ratification of the stockholders is not required for appointment of independent auditors under Delaware law or our By-Laws, the Board of Directors believes it is appropriate to seek stockholder ratification of the appointment of Ernst & Young LLP as independent auditor.2014. 2023. In connection with the current appointment of the independent auditor, the Audit Committee reviewed with representatives of Ernst & Young LLP the most recent report of the PCAOB on the overall quality of the firm’s audit work.20162024 annual meeting and will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.20152023 and 2014paidincurred by ProAssurance for audit, audit-related, tax and other services provided by Ernst & Young LLP to ProAssurance during each of the last two years. 2015 2014 $ 2,411,100 $ 2,602,890 0 0 0 0 0 0 $ 2,411,100 $ 2,602,890 2023 2022 Audit fees $ 4,520,596 $ 4,326,225 Tax fees 574,950 493,921 All other fees — — Total $ 5,095,546 $ 4,820,146 in 2015for 2023 that required the pre-approval of the Audit Committee were approved in accordance with our pre-approval policies and procedures described below.Under the Sarbanes-Oxley Act of 2002, the audit committee of the Board of DirectorsTo implement these provisions of the Sarbanes-Oxley Act, theThe SEC has issued rules specifying the types of services that an independent auditor may not provide to its audit client and governing the audit committee’s administration of the engagement of the independent auditor. Our Audit Committee has adopted an Audit and Non-audit Service Pre-approval Policy, which sets forth the procedures and the conditions pursuant to which services proposed to be performed by our independent auditor may be pre-approved.shouldis necessarily be determinative.18have historically been provided by the independent auditor;AccountingFinancial Officer or outside counsel to determine that tax planning and reporting advice is consistent with this policy.19AccountingFinancial Officer as to whether, in their view, the request or application is consistent with the SEC’s rules on auditor independence.AccountingFinancial Officer is responsible for tracking all independent auditors’ fees against the budget for such services and report at least quarterly to the Audit Committee.this policy. Our internal auditor reports to the Audit Committee on a periodic basis on the results of its monitoring. Both our internal auditor and management will immediately report to the ChairmanChair of the Audit Committee any breach of this policy that comes to the attention of the internal auditor or any member of management. The Audit Committee will also review our internal auditor’s annual internal audit plan to determine that the plan provides for monitoring of the independent auditor’s services.20162024 will require the affirmative vote of a majority of the shares voting on the matter at the 20162024 annual meeting. If you vote your shares without instructions to your proxy on this proposal, your shares will be votedFORthe ratification of the appointment of Ernst &Young& Young LLP. In the event that the appointment of Ernst & Young LLP as independent auditor for 20162024 is not approved by the affirmative vote of a majority of the shares voting on the matter, the Board of Directors will request that the Audit Committee reconsider its appointment of independent auditors for the year ending December 31, 2016.2016.www.ProAssurance.com.http://investor.ProAssurance.com/govdocs. During 20152023, the Audit Committee met teneight times. In conjunction with some of these meetings, the Audit Committee met in executive sessions and met in separate sessions with our independent auditor, our internal auditors, our Chief Executive Officer and Chief Financial Officer, our Chief Accounting Officer and our external corporate counsel.20boardBoard for the appointment, compensation and oversight of the work of the independent auditor. The independent auditor reports directly to the Audit Committee.16, including the following, if applicable: (i) overall audit strategy, timing of audit, and significant risks identified by the auditor; (ii) significant issues discussed with management in connection with the auditor’s appointment; (iii) the auditor’s responsibility under standards of the PCAOB; (iv) the quality; acceptability and disclosure of significant accounting policies and practices; (v) identification and assessment of critical accounting policies and estimates; (vi) significant unusual transactions; (vii) difficult or contentious matters subject to consultation outside the audit team; (viii) new accounting pronouncements; (ix) material alternative accounting treatments discussed with management; (x) corrected misstatements related to accounts and disclosures; (xi) uncorrected misstatements considered by management to be immaterial; (xii) significant deficiencies and material weaknesses in internal control over financial reporting; (xiii) adequacy of management’s disclosures about its internal control assessment and any changes in internal control; (xiv) other information in documents containing audited financial statements; (xv) fraud and illegal acts that involve senior management or that cause a misstatement of the financial statements; (xvi) related party relationships and transactions; (xvii) independence matters; (xviii) pre-approval of services to be performed by the independent auditors and fees billed for such services; (xix) significant difficulties encountered in performing the audit; (xx) disagreements with management; (xxi) management’s consultations with other accountants on auditing matters; (xxii) provision of all material written communications between the auditor and management; (xxiii) information regarding the auditor’s use of third party services providers; (xxiv) the auditor’s internal quality control procedures; (xxv) material issues raised in quality control reviews of the auditor within the last five years and steps taken to deal with the issues; and (xxvi) all relationships between the auditor and ProAssurance.1301. In addition, the auditor is required to inquire as to whether the Audit Committee is aware of matters relevant to the audit such as fraud or possible violation of laws and is further required to communicate to the Audit Committee any other matters arising from the audit that are significant and relevant to the Audit Committee regarding its oversight of the financial reporting process.did not perform anyperformed limited non-audit services in 2015.2120152023 be included in its Annual Report on Form 10-K for the year ended December 31, 2015,2023, prior to the filing of such report with the SEC.Ann F. Putallaz, Ph.D.Frank A. Spinosa D.P.M. 201634 — ADVISORY VOTE ON EXECUTIVE COMPENSATION20152023 reflects and supports these compensation policies and procedures.34 requires the affirmative vote of a majority of the shares voting on the matter at the 20162024 annual meeting without regard to broker non-votes or abstentions. Accordingly, we will ask our stockholders to vote on the following resolution at the Annual Meeting:20162024 Annual Meeting of Stockholders pursuant to the compensation disclosure requirements set forth in Item 402 of Regulation S-K of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the 20152024 Summary Compensation Table and the other related tables and narrative discussion.”34 (Advisory Vote on Executive Compensation).22

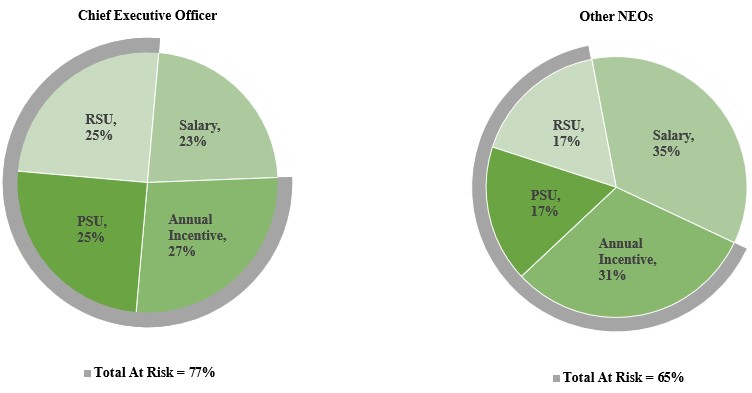

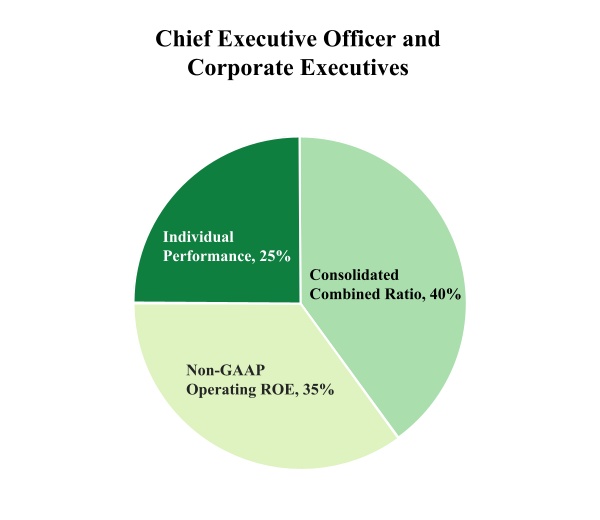

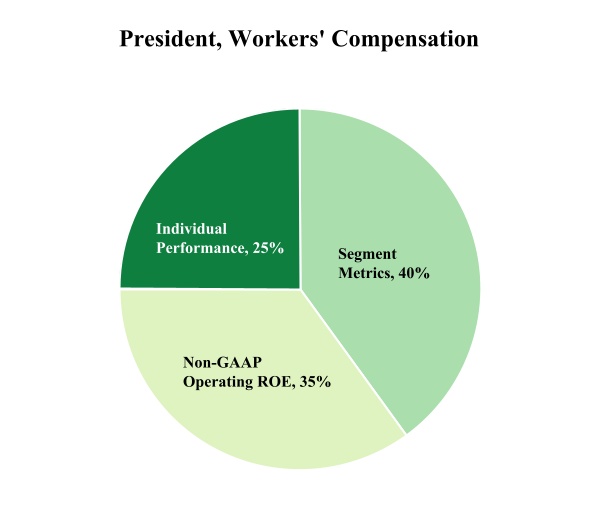

will addressdescribes our compensation practices with respect to our Chief Executive Officer (“CEO”) and the other executive officers named in the Summary Compensation Table on page 3531 of this proxy statement, whichwhom we refer to as our “executives” in the discussion.OverviewName Title Edward L. Rand, Jr. President and Chief Executive Officer Dana S. Hendricks Executive Vice President and Chief Financial Officer Jeffrey P. Lisenby Executive Vice President, General Counsel & Secretary Kevin M. Shook President, Workers’ Compensation Segment Robert D. Francis President, Healthcare Professional Liability that is designed to attract and retain qualified and motivated individualsengaged executives and reward them based on performance. Our executive compensation follows theprogram aligns pay for performance as demonstrated through a compensation format generally applicableframework in the insurance industry consistingwhich 77% of our Chief Executive Officer’s 2024 annual target total direct compensation is “at-risk.” Total compensation consists of base salary, annual incentive compensation, and long-termlong- term incentive compensation.We emphasize incentive compensation that rewards our executives for the achievement of short-term and long-term strategic and operational goals. Our compensation program for executives contemplates a base salary that is competitive in the market. Our goal is to place a majority of our executives’ compensation relative to base salary at risk in the form of annual and long-term incentive compensation, while at the same time avoiding the encouragement of unnecessary or excessive risk-taking. In 2015 the “at risk” compensation (sum of annual incentive and three year average of long term incentive) received by our Chief Executive Officer was approximately 74.4% of total compensation and the “at risk” compensation received by our other executives ranged from approximately 56% to 69.5% of total compensation (sum of base salary, annual incentive and three year average of long term incentive). This reflects our objective to reward performance and to link rewards to our strategic business objectives.Our annual Annual incentive compensation is intended to maximize the efficiency and effectiveness of our operations by providing compensation based on annualachievement of pre-defined performance measures formetrics by our executives.Our long-term Long-term incentive compensation is intended to reward executives for driving results that achieve long-term growth in stockholder value.